Understanding Current Balance vs. Available Balance in Your Account

One of the major sticking points for people can be the current balance versus available balance of their credit union accounts. As more people move to online banking from the days of manually balancing a checkbook, this difference can be critical in how much money you have at your disposal. This leaves many people wondering, "What does it really mean when I check my account balance?"

TEFCU offers overdraft protection as a backup plan in case you make a mistake in your balancing. However, it's important to understand the differences between current balance and available balance, and how that can affect your spending and planning.

What does current balance mean in my account?

When you look at your TEFCU account online or speak with a Member Services Representative, the current balance is the total amount of money kept in the account. As you will learn soon, this may not be the most accurate picture of your account's status.

What does available balance mean?

Your available balance is the amount of money in your account, minus any credits or debits that have not fully posted to the account yet. This is the amount of money you can spend, but it may not fully reflect the money you have at your disposal.

Why are my current balance and available balance different?

You may notice upon checking your account balance that these two numbers are not the same. If you've made recent purchases with your debit card, but the financial institution hasn't fully processed the transaction, the current balance will be higher than the available balance. This is also the case if you have written a check that has not yet cleared.

Can I spend my current balance?

You can, but you have to be mindful about other financial transactions you have made.

To use an example, let's say both your current and available balance are at $100. You use $10 to buy coffee in the morning. Your current balance would still say $100 since the transaction at the coffee shop is still pending. However, your available balance would be $90. This will mean if you also had a check that you mailed that was for $100 and it cleared, your account would be overdrawn by $10.

You should keep an eye on your available balance if you have recurring payments or a large purchase to make, as that is the balance most affected by new transactions. Further you should track all debits, credits, and purchases and frequently monitor your account balances (available and current balance).

Do pending transactions show in the current balance?

No, your pending purchases do not appear in the current balance. That total is the sum of all cleared and posted transactions. So any purchases you've made in the last day or two (or longer depending on the day of the week) will not show in the current balance. Your available balance is the more accurate snapshot of how much money you have in the account since it does reflect pending transactions.

Why is my available balance more than my current balance?

There are a couple of explanations for this occurrence. One is that you may have recently deposited a check, either via an ATM or mobile deposit. Some financial institutions will add the deposit to your available balance but will not add it to the current balance until they verify the check is good and receives funds from the issuing financial institution.

How can I determine my current balance vs. available balance?

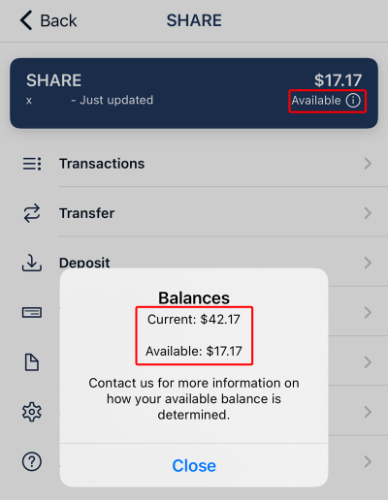

In TEFCU Mobile and Online Banking, click on the "Available" icon under your balance to see your current and available balances.